The Road Ahead: Managing the Automotive Chip Shortage

It's true that no business was prepared for the pandemic, but you'd be hard-pressed to find an industry that has been more impacted by the challenges of the past few years than automotive.

The industry's supply chain was built on the principles of just-in-time manufacturing and single-sourced components, but those standard operating procedures quickly became liabilities in our new era of automotive chip shortages. As COVID-19-related shutdowns and safety measures persisted beyond the initial outbreak, component shortages continued to grow, and OEMs have been forced to compete with other industries for semiconductors.

Additionally, facing unyielding demand despite these high prices, OEMs are making tough choices about the features they include in their new vehicles. Many of the top automotive OEMs have temporarily removed features that require backordered chips — like rear heated seats, wireless smartphone charging, and premium audio or touchscreen functionality — from some of their models to get the cars out to consumers as quickly as possible.

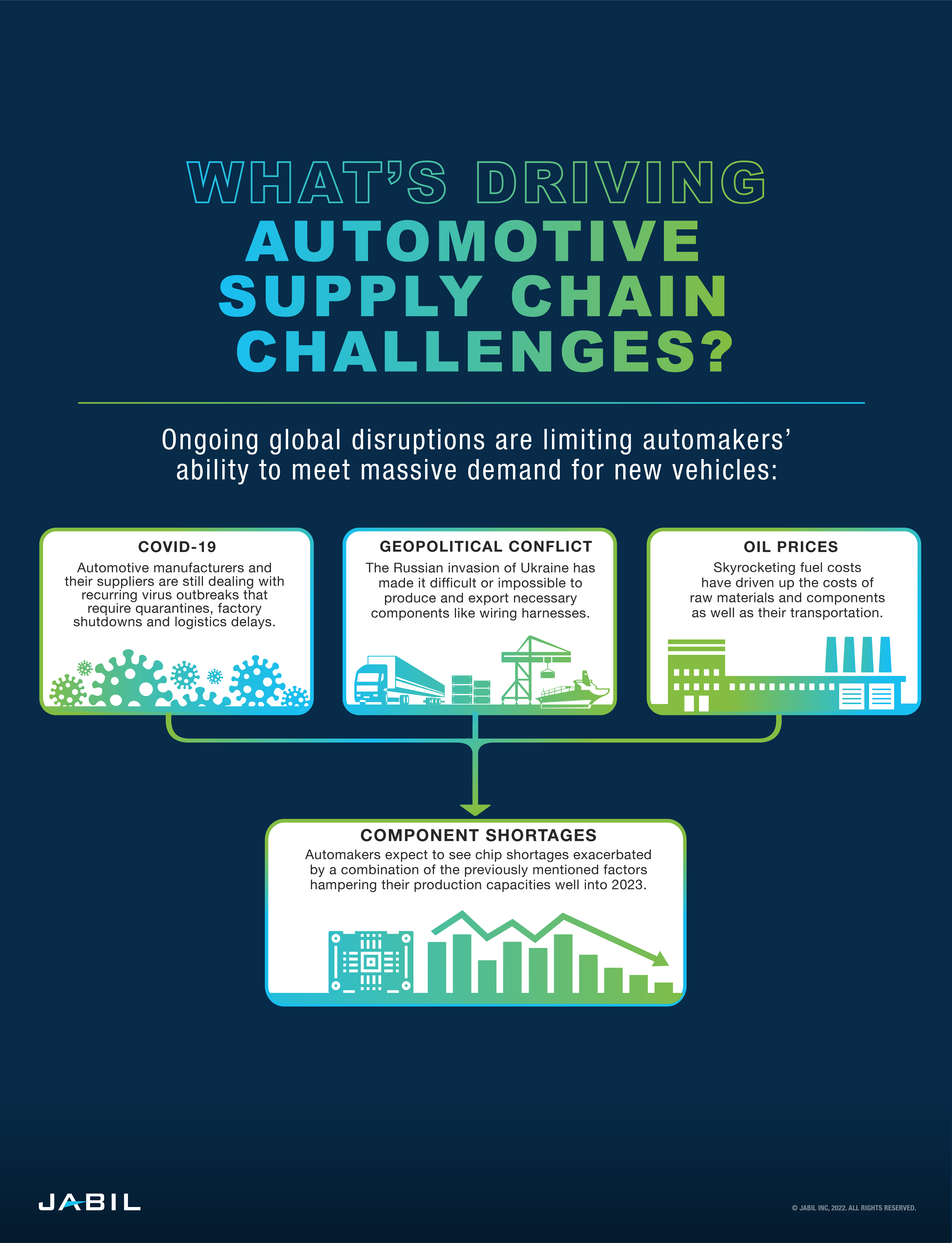

A 2022 survey by IndustryWeek and Jabil dug a little deeper into the specific challenges facing automotive supply chains. The survey polled 100 professionals at various levels and in various roles at automotive original equipment manufacturers (OEMs) around the world. Supplier component and material shortages topped the list of challenges, with 81% of participants experiencing a moderately to severely negative impact from this challenge. In conjunction, 67% faced moderately to significantly negative impacts from component and material price increases, while 72% have seen long lead times for these components and materials. Furthermore, component shortages are the top challenge that automotive OEMs expect to continue into the near future. At this time, we expect the auto industry to be impacted by semiconductor shortages well into 2023.

How Component Shortages Have Rattled the Automotive Industry

Between early 2021 and early 2022, automotive OEMs have faced shortages of:

- Semiconductors (58% of survey respondents)

- Printed circuit boards (40%)

- Plastics (27%)

- Steel (25%)

- Wiring harnesses (24%)

- Rare earth materials (21%)

- Resins (17%)

- Glass (17%)

- Other materials and components (8%)

The hardest-to-find component lately has been semiconductors. The chip shortages date all the way back to 2019. The main reasons for the shortage of automotive semiconductors are known. Auto OEMs drastically reduced their semiconductor orders at the onset of the COVID-19 pandemic in early 2020, fearing they would end up with excess inventory of cars if demand fell significantly due to the pandemic. When the OEMs tried to increase orders, they had lost their place in line and were behind other industries such as consumer electronics and smartphones, Semiconductor Intelligence recalls.

At the same time, and in response to consumer and environmental pressures, most automotive manufacturers are shifting gears to focus on bringing new electric vehicle models to market. This concentration on electric vehicles has pushed demand for semiconductors to new heights — compounding the demand from other smart, connective automotive features that also require chips.

As a result of not obtaining the semiconductor chips they need, automotive OEMs have had to:

- Delay shipments to customers and dealers (59% of survey respondents)

- Delay the introduction of certain high-tech features and offerings (33%)

- Lay off or furlough employees (33%)

- Eliminate work shifts at their production facilities (31%)

- Delay the introduction of new products (29%)

- Close plants temporarily or permanently (26%)

More than a third (38%) of survey respondents have lost revenue as a result of the component shortages as well. Consumer Reports corroborates this data, reporting that 1.7 million fewer vehicles were produced in 2021 compared with 2019, the last full year before the pandemic, mostly because of the chip shortage. S&P Global identifies the chip shortages as one of the main factors contributing to their downgraded production forecast for 2022. "Currently the greatest risk to the outlook comes from the threat of further or prolonged lockdowns in mainland China and the contagion into already stressed global supply chains," said Mark Fulthorpe, Executive Director, Global Production Forecasting, S&P Global Mobility.

Since this IndustryWeek and Jabil survey was fielded, other global events have disrupted automotive supply chains even more. Russia's invasion of Ukraine, which started in February 2022, cut automotive OEMs off from other components typically provided by Ukraine as well as materials typically provided by Russia. Russia produces common minerals and metals, such as iron; nickel, which is needed for electric vehicle batteries; and about 40% of the world's raw palladium, which is used to clean vehicle exhaust. Ukraine traditionally is a major supplier of wiring harnesses to EU auto OEMs. You can start building a car while waiting for chips, but there's no point in starting production if you don't have wiring harnesses ready to go.

As a result, automotive analysts cut production and sales forecasts for 2022 and 2023, and automotive factories in Europe had to temporarily suspend production. Wolfsburg, Germany-based Volkswagen delayed the launch of its ID.5 electric car by a month because of a lack of wiring harnesses. By May 2022, the company's CEO Herbert Diess said the company was "basically sold out" of electric cars for the year because it had an order backlog of 300,000 vehicles. Ukrainian suppliers have valiantly tried to continue operations to support global automotive supply chains, but workers have had to flee as conflict neared.

The conflict in Ukraine also was one of the factors that sent global gas prices skyrocketing, increasing the costs of distribution and transportation. This has pushed up the price of just about everything that needs to be transported at some point in its life cycle, adding even more price volatility to the automotive components market. Component shortages and logistics challenges had already driven up prices for raw materials; the price of aluminum alone jumped approximately 30% between December 2021 and March 2022. Inflation stemming from supply chain disruptions and other market factors has sent prices even higher.

COVID-19-related lockdowns in China also have disrupted automotive production. As factories closed in certain regions to prevent the spread of COVID-19, factories in other areas could not receive the materials and components they needed to continue production. In Shanghai alone, large automotive OEMs saw a 75% decline in production in April 2022, and China as a whole recorded a more than 40% drop in passenger vehicle production.

OEMs are not just struggling to obtain production parts; they are running into a lack of replacement parts too. In July 2022, General Motors recalled about 682,000 Chevrolet Equinox and GMC Terrain SUVs because of possible windshield wiper failure. However, the company informed affected customers that GM did not have the replacement parts to address the recall at the time, saying it had to wait for suppliers to build the parts before it could begin repairs. Without functioning windshield wipers, drivers are at a higher risk of crashes during rainy weather.

Strategies for Navigating Automotive Component Shortages

Based on these recent events, it's almost certain that component shortages are here to stay for at least the near future. A lack of components can stop automotive production in its tracks. Here are four strategies that can help:

1. Improve supplier collaboration to overcome component and material shortages

Increased demand is not the only hiccup in obtaining needed components; it's the traditional approach to procurement that is causing delays. Traditionally, automotive manufacturers would send demand signals to their suppliers close to production time. In many cases, components made from metal or via plastic injection do not take long to make, demand is well established, and supply is in balance, so there can be tighter turnarounds between component or material orders and deliveries.

Because chip demand is less established and there are no spare chips lying around, chip suppliers must start production from scratch when they get a new order. It could take at least nine to 12 months to deliver a new chip order.

The bright spot is that automotive manufacturers are learning. They are giving suppliers demand forecasts that predict 18 to 24 months out, which is a significant supplier collaboration improvement compared with just two years ago. However, it is one thing to give a far-reaching forecast, but it can be another thing to give an accurate forecast. In order to smooth out the chip supply chain hiccups, buyers must provide suppliers with accurate forecasts that enable suppliers to deliver to actual demand without too much surplus or shortage in the end.

While these kinks are worked out, some automotive manufacturers are still succeeding at obtaining at least some of the chips they need. One is Japan-based Toyota Motor Corp. The OEM directed its suppliers to increase their semiconductor inventory levels from three months to five months. Although this strategy goes against Toyota's famous just-in-time inventory management and production strategy, it gives them buffer inventory to keep production moving. Although this strategy shift technically made the company less efficient in terms of inventory management, Toyota continued to churn out record-breaking profits and even hit record production levels.

In a way, this method did maintain Toyota's just-in-time strategy, though. Instead of carrying the inventory itself, it put the task of maintaining additional safety stock on its suppliers. The suppliers likely are responsible for covering the cost of the inventory, storing it and transporting it until Toyota needs it.

This strategy could work well for a company that has strong supplier relationships. However, it is less likely to work for a company that only has casual-at-best relationships with its suppliers. Some companies are asking for 14 to 28 weeks of buffer stock, which represents millions of chips, and suppliers do not want to absorb that responsibility. However, a supplier might be willing to make accommodations for a customer of choice.

Automotive suppliers may not yet realize the burden just-in-time production places on their supplier relationships. A whopping 46% of the 100 survey respondents said they have no plans to reevaluate or move away from just-in-time production. However, 22% of respondents did shift their production strategies after the pandemic, and another 17% are planning to reevaluate their just-in-time practices.

Being a customer of choice is the key strategy for securing the materials and components a company needs. In the automotive industry, this means increasing supplier collaboration and visibility, not only into demand forecasts but also into research and development plans. If a supplier can collaborate with a customer on R&D, the supplier can better understand the customer's needs and better prepare for future demand.

The other side of the relationship is for the customer to understand the suppliers' needs and preferences. Going back to the example of a supplier carrying buffer stock for a customer, if a customer offers to compensate the supplier for the buffer stock they are holding, they will improve their relationship with that supplier because the customer is taking the supplier's concerns into account.

Other steps Jabil survey respondents are taking to improve their supplier relationships include:

- Evaluating supplier manufacturing practices (39%)

- Increasing on-site visits to supplier operations (35%)

- Extending technological capabilities or sharing technology platforms to increase visibility (35%)

- Conducting supplier surveys to address their pain points, resiliency and how the customer can help them (32%)

- Implementing supplier relationship management programs (29%)

2. Investment in supply chain agility provides more options

Another key to skirting components shortages is agility. This is an area where car manufacturers with expertise in software shine. OEMs with a specialization in technology are accustomed to switching gears quickly and qualifying new parts to keep pace with changing needs, markets and technological demands. If an OEM with tech-driven, standardized processes for new part qualification runs into a component shortage, it can qualify a new part significantly faster than a traditional automotive OEM — putting the tech-focused OEM at the front of the race for procuring materials or components. For example, an agile OEM could use technology to navigate the chip shortage by rewriting its automotives' software to work with the available chips or simplifying the electronics in the vehicle to reduce its chip needs.

Creating more flexible internal processes is just the first step to agility. Setting up local supply chains can also speed up an organization's operations. By sourcing components or materials locally or taking advantage of local services, organizations can cut lead times as well as their environmental footprint, which is something groups are increasingly aware of as governments roll out more environmental standards and regulations.

However, many organizations are hesitating to reshore or nearshore their supply chains. One prominent factor is labor costs. American and European companies cannot compete with Asian companies on price when you factor in local labor costs. And when organizations realize a local supplier would cost more, they might back away. In the U.S., the recently passed CHIPS Act is meant to combat this very problem. The law will provide semiconductor manufacturers with more than $52 billion over five years to increase production in the U.S., with the goal of making nearshored supply chains more cost-effective for OEMs.

Offshoring to Asia still may be the best option for some, as indicated by the nearly 40% of IndustryWeek and Jabil survey respondents who indicated that they have no plans to reshore or nearshore production, while only 23% reshored or nearshored production post-pandemic, and another 25% plan to nearshore or reshore. However, depending on the components, auto manufacturers need to consider total costs when balancing offshoring versus reshoring and nearshoring opportunities. They should take into consideration factors like component or material quality; ease of communicating and collaborating with a nearby supplier; ease of visiting a nearby supplier for inspections or increased collaboration; transportation costs; energy costs; lead time; and agility in changing design in order to figure out the best supplier option.

When possible, it is prudent to partner with a variety of suppliers in different geographic regions. That way, when a risk strikes one supplier, the customer can shift orders to suppliers in another region to keep operations moving while the affected supplier recovers.

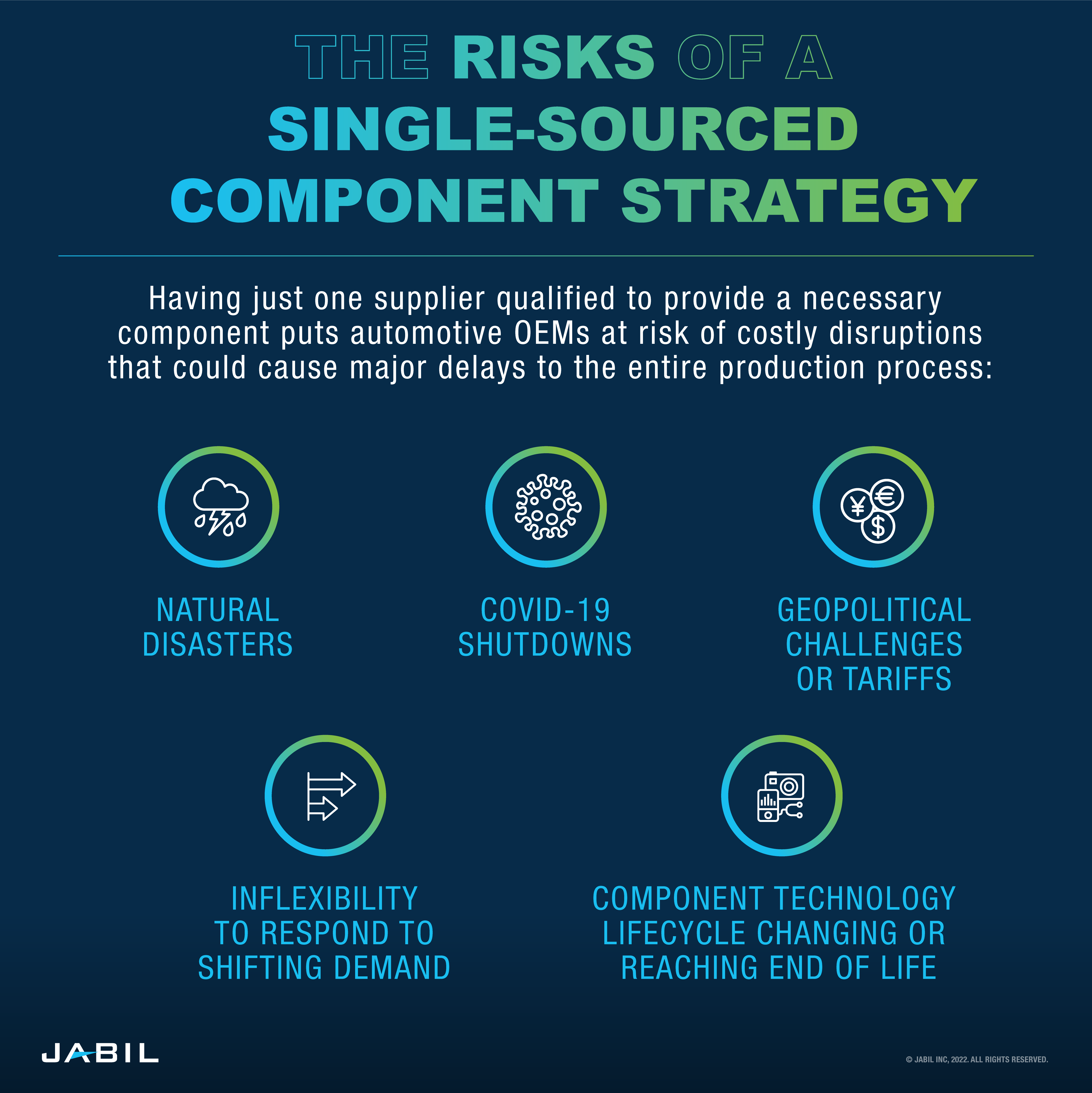

3. Hedge risks with multi-sourcing strategies

Before the COVID-19 pandemic, too many automotive components were single source, meaning that the manufacturer relied on one supplier to deliver the needed quantities of a part. This is risky because if a disruption happens, that supply is choked off. Recent events such as the 2011 earthquake in Japan, the COVID-19 pandemic and the 2022 invasion of Ukraine should convince automotive manufacturers that relying on just one supplier for a component is insufficient. It costs little to qualify alternate suppliers during the design of the products compared to the benefits, which will far outweigh the risks of a supply interruption.

Respondents to the IndustryWeek and Jabil survey indicated that they are focused on diversifying their supply bases. Forty percent of respondents implemented this practice post-pandemic, and another 25% are still working on diversification.

When choosing new suppliers, especially when it comes to semiconductors, OEMs typically have little information to go on beyond a supplier's technology and its cost. It is hard to learn about a supplier's performance record for quality or on-time delivery, for example. This can make supplier selection particularly challenging, especially as 34% of Jabil survey respondents said on-time delivery from suppliers is important to their supply chain success, and 30% said supplier lead times have an important impact.

This ultimately leaves the customer at the mercy of the supplier's operational schedule. Here is where a manufacturing partner with intelligent digital supply chain solutions like Jabil can come in. Jabil has insights into a variety of suppliers, which gives us the ability to connect our clients with the suppliers that will best meet their operational needs.

4. Shift operations strategies to outsource risk

As automotive OEMs move from the mechanical world to the electronic world, they are now understanding that the brand's intellectual property — and therefore the value — is in the development of electronic products for their platforms. To take more control, OEMs are investing more in in-house research and development capabilities and engineering teams to develop the technology, then working with suppliers to industrialize and manufacture the products.

For now, it makes sense to outsource -non-core technology manufacturing. Bringing manufacturing in-house is capital intensive because the company would have to buy machines and hire operators to run them. By comparison, it is more affordable for a company to hire a team of engineers and then leave the manufacturing to companies that already have the necessary equipment.

By outsourcing to a manufacturing partner, such as an electronic manufacturing services provider (EMS) or manufacturing solutions provider, an OEM can in turn outsource some of its risk. For example, the pandemic has highlighted the overreliance that the automotive industry has placed on a handful of global semiconductor chip suppliers. Outsourcing to a manufacturing partner can help reduce the risk created by this single-source strategy in a few ways. First, manufacturers like Jabil who are purchasing components and materials in massive quantities can help by leveraging their spend volume and relationship with suppliers of choice to ensure automotive OEMs receive at least some, if not all, of the chips they need in a timelier fashion than OEMs can achieve on their own.

Second, manufacturing partners have a broad base of vetted suppliers from which to draw from when one supply line experiences a disruption. At Jabil, we work with 27,000 suppliers around the world, so OEMs always have a second or even third option if their primary supplier cannot fulfill an order on time. Partnering with a manufacturing solutions provider to outsource parts of the automotive production process may also allow companies to make more investments in supply chain risk management, which 75% of survey respondents plan to do within the next five years. Only 14% had no plans to implement this strategy.

Based on the sales and production numbers of automotive OEMs during the past couple of years as well as the disruptions that have popped up since then, new vehicle production will continue to suffer if automotive supply chains can't get component shortages under control. The value of supply chain continuity is extremely high. If a company thinks it can continue to adopt a complacent, wait-and-see approach, it needs to weigh the bottom-line impact of higher supply chain management costs with the losses associated with production disruptions.

Investments in supply chain certainly pay off when they enable production to continue and allow OEMs to fulfill consumer orders. Adopting one or more of these strategies also will give an automotive supply chain more resilience to better handle any unforeseen disruptions down the road. With the right preparation and strategy shifts, the significant challenges of today can become minor blips on the dashboard in the future, and OEMs can steer clear of other problems on the road ahead.